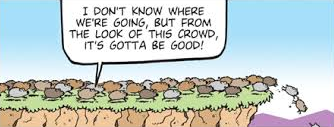

In today’s digital world, the trading industry has developed a lot. New methods and strategies have been invented. But some aspects of trading remain the same. One of these is herd behavior. What exactly is it, and how can you use it to your advantage? Read on.

What is herd behavior?

Trading has always been affected by herd behavior. This is the tendency of individuals to copy the actions of others, especially when they believe that these actions will lead to success. When it comes to trading, this means following the lead of other traders, especially when it comes to making investment decisions. For example, if most people are buying a certain stock, others will be more likely to buy it too, in the hope of making a profit.

Herd behavior can lead to market crashes or bubble formations. This is when everyone buys a certain asset, pushing up prices to unrealistic levels. This can happen in any market but is especially common in the stock market, where prices quickly change.

Reasons why people engage in herd behavior

It is human nature to want to belong to a group and to feel like we are doing the right thing. This is especially true when it comes to making important decisions, such as investing money. We are also influenced by social norms, which can lead us to make investment decisions based on what others are doing rather than on our own research.

Additionally, herding behavior gives most people a feeling of safety and certainty. This is because it takes the guesswork out of decision-making. When we follow the lead of others, we don’t have to worry about making the wrong decision. This is especially true in a volatile market, where prices can change rapidly, and it’s hard to know what is going to happen next. We think that there must be a reason why people are making a certain move and most often think it is the right thing to do.

Herd behavior can also be caused by fear. When the stock market is volatile, people can become scared and start to sell their stocks. This can lead to a sell-off, as other investors see the selling as a sign that it is time to sell too. We have seen this happening a lot in the last few years.

How can you use herd behavior to your advantage?

Although herd behavior can lead to some negative consequences, you can also use it to your advantage. Whether you are a novice or a pro into trading, there is always something to learn from the shifts that happen in the markets. Here are a few tips for you;

1. Do your own research

You shouldn’t just blindly follow the crowd. It is important to do your own research before investing in any asset. This includes reading news articles and financial reports, as well as talking to experts. Also, ensure that you are up to date with the market trends. By doing your own research, you will be able to make investment decisions based on your own analysis rather than following the lead of others.

2. Be aware of your emotions

When it comes to trading, keep your emotions in check. When the market is volatile, it can be easy to make decisions based on fear or greed. However, these emotions can lead to bad investment decisions. Instead, focus on making rational decisions based on your research. Before making any move, think twice about it. Do not just buy or sell stocks based on what others are doing.

3. Have a plan

If you want to grow your portfolio, you need to have a plan. This includes setting investment goals and sticking to them. It is also important to have a diversified portfolio, which will help to reduce your risk exposure.

4. Use stop losses

Stop losses are a tool that can help you to make a profit in volatile markets. They are designed to automatically sell a security when it reaches a certain price. By using stop losses, you can protect your profits and limit your losses.

5. Be patient

Herd behavior can cause stocks to move quickly in either direction. If you are looking to make a quick profit, then you will likely be disappointed. You need to be patient and let the market come to you. This doesn’t mean that you shouldn’t take any action; it just means that you should wait for the right opportunity before investing.

Bottom Line

So, is herd behavior a good thing? The answer to this question is a bit complicated. On the one hand, herd behavior can lead to some negative consequences, such as buying high and selling low. However, you can also use it to your advantage by doing your own research and staying calm when the market is volatile. By using these tips, you can make rational decisions based on your analysis.